Property For Sale In Palm Jebel Ali Dubai

- All

- Houses

- Villas

- Plots

- Apartments

- All

- Houses

- Villas

- Plots

- Apartments

Palm Jebel Ali by Nakheel

Unmatched Size

Serenity and Beauty

First-Class AMENITIES

Smart Sustainability

An Icon in Dubai's Thriving Southern Center

Palm Jebel Ali Location

Key Advantages at Palm Jebel Ali

An ideal paradise-like archipelago

Dubai's lengthiest coastline

Impressive properties and five-star amenities

Carefully designed private neighborhoods

Elegant streets and lush, layered flora

Elegant homes of the highest quality

A serene green oasis for an active lifestyle

The sandy beach is just steps away

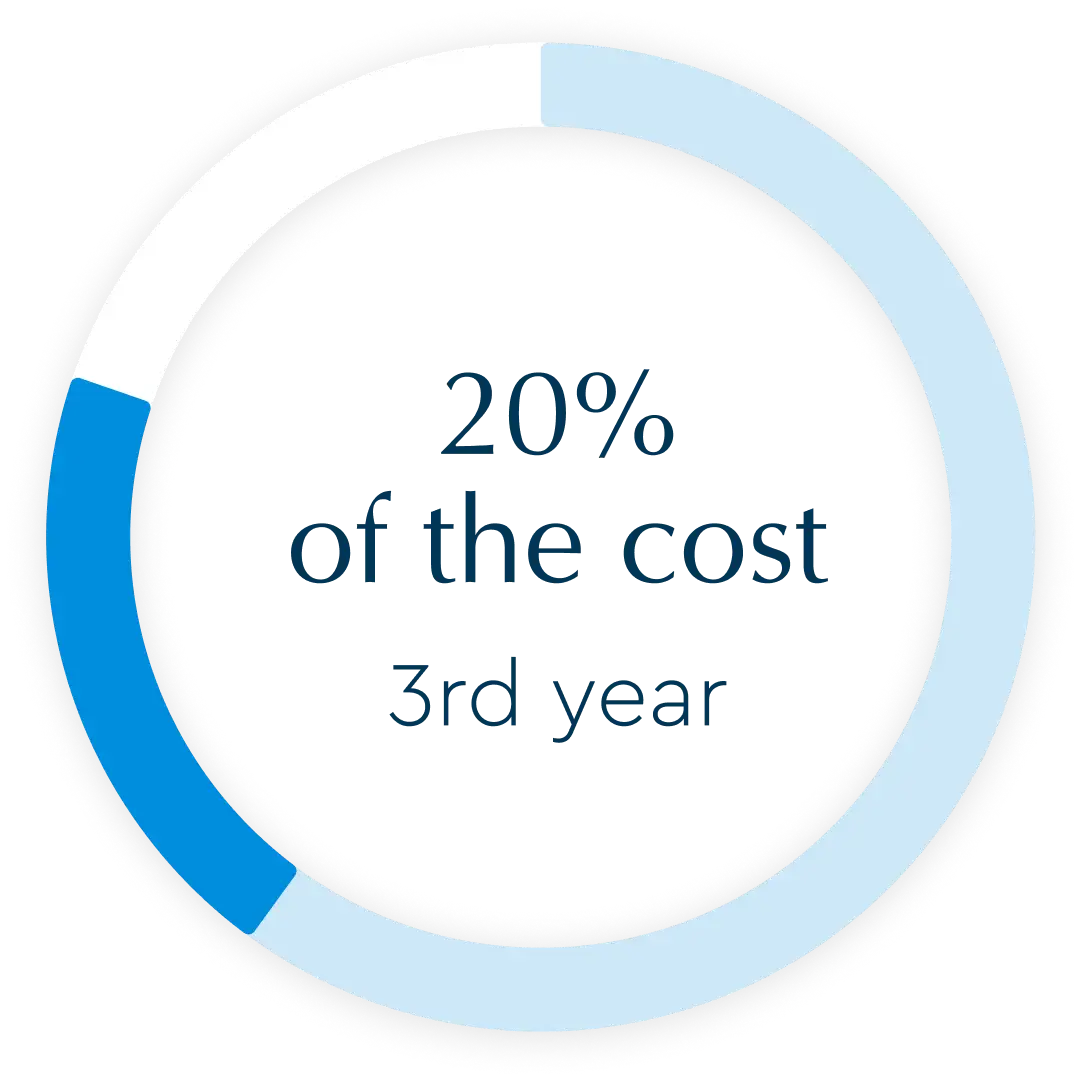

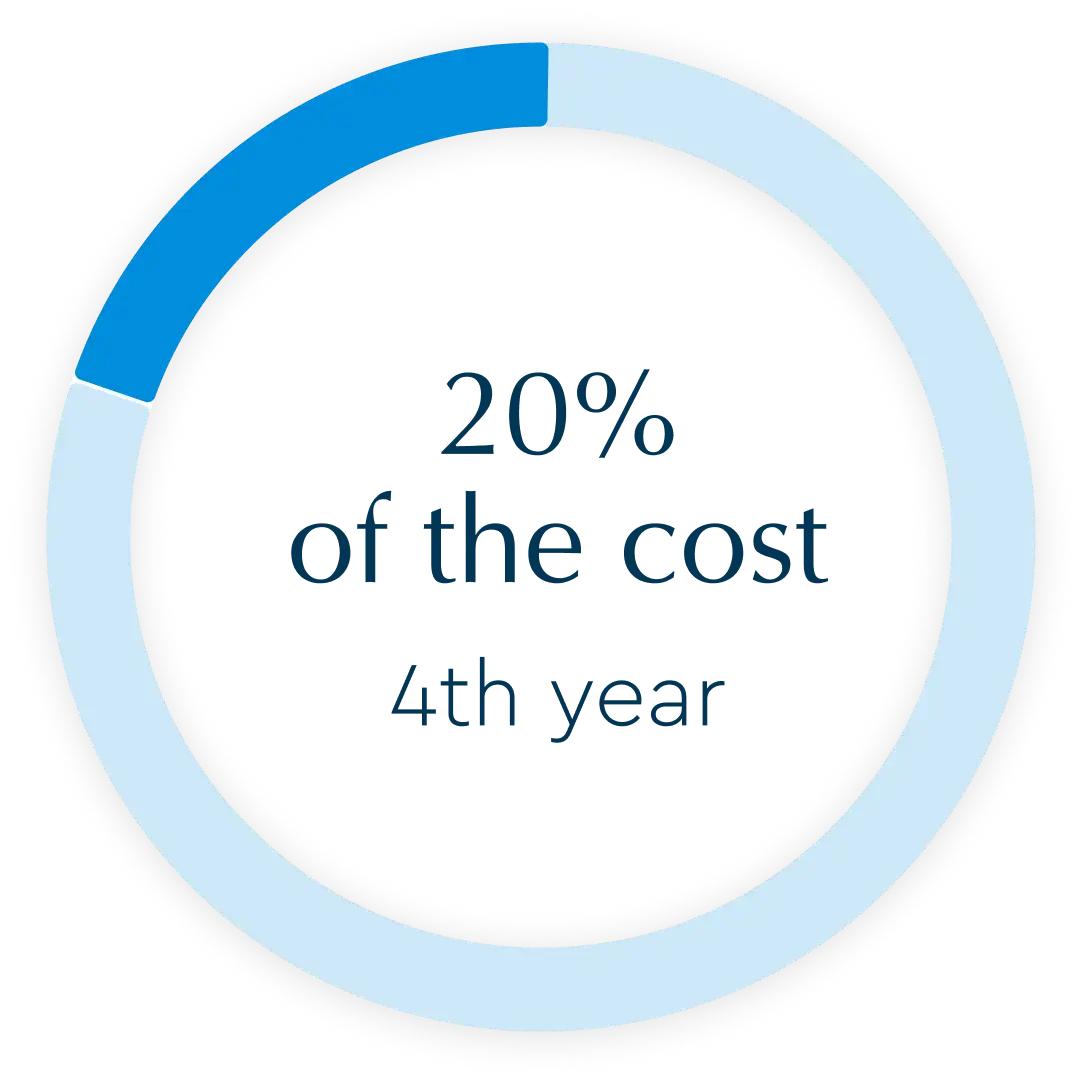

Palm Jebel Ali Payment Plan

0% Installment for 4 years

(as a percentage of the property’s value)

Palm Jebel Ali Investment Appeal

Palm Jebel Ali Villa Price

| 🟢 Property for Sale | 🟢 Area | 🟢 Price |

| 5-Bed | From 732 sq.m. | $4.9M / AED 18M |

| 6-Bed | From 679 sq.m. | $5.4M / AED 19,9M |

| 7-Bed | From 1064 sq.m. | $8.9M / AED 33M |

Palm Jebel Ali Plots Price

| 🟢 Property for Sale | 🟢 Area | 🟢 Price |

| Residential Plot | From 1299 sq.m. | $10.6M / AED 39M |

| Residential Plot | From 2110 sq.m. | $11.3M / AED 41.6M |

Infrastructure

In the heart of Dubai, Palm Jebel Ali enjoys convenient connectivity to mainland Dubai via Sheikh Zayed Road. The masterplan envisions three access points to the island, ensuring easy accessibility and fostering a sense of integration with the vibrant cityscape.

The strategic location places it approximately a 30-minute drive away from Al Maktoum International Airport, offering residents and visitors a swift and hassle-free travel experience. The same travel time opens the doors to the allure of Dubai Marina and the enchanting Palm Jumeirah.

As the area continues its dynamic development, the present landscape unfolds with luxurious hotels, inviting resorts, trendy nightlife venues, fine dining establishments, and exclusive entertainment options.

Palm Jebel Ali Sights

Palm Jebel Ali Palace for Sheikh Mohammed Bin Rashid Al Maktoum

MOON

Yacht Club

Luxurious Beach

Elite hotels and resorts

About the Developer

PALM JEBEL ALI: A REMARKABLE REAL ESTATE DEVELOPMENT

PALM JEBEL ALI

PALM JEBEL ALI

KEY FEATURES

The island is a visionary project developed by Nakheel, one of Dubai’s premier real estate developers. This ambitious project, which is poised to redefine luxury living in Dubai, received personal approval from Sheikh Mohammed bin Rashid Al Maktoum, the Vice President and Prime Minister of the UAE and the Ruler of Dubai.

- Impressive Size. Is an expansive island, surpassing the scale of its renowned sibling, Palm Jumeirah. Its sheer size emphasizes Dubai’s commitment to grandeur and innovation in urban planning. Stretching along the picturesque Arabian Gulf, it spans vast expanses, offering a breathtaking waterfront experience.

- Sustainability. This ambitious project aligns seamlessly with Dubai’s dedication to sustainability and smart city technology. It stands as a beacon of eco-friendly development, with more than 30% of its public facilities powered by renewable energy sources. Moreover, it incorporates green building practices and sustainable design principles to ensure harmony with the environment.

- Luxurious Accommodations. It’s not just be about size and sustainability; it also be about luxury living. The development features over 80 hotels and resorts, promising a lavish lifestyle for its future residents and visitors alike. Its array of residential options include opulent villas and apartments, catering to diverse preferences.

Under Nakheel’s expertise and Sheikh Mohammed’s vision, project represents a remarkable addition to Dubai’s coastal landscape, combining opulence, sustainability, and innovation.

LOCATION

It is located within the Jebel Ali District in Dubai, making it a highly sought-after destination with numerous benefits. Its prime location along the coastline of the Arabian Gulf offers residents and investors a unique blend of advantages.

- Coastal Paradise. It’s situated along the picturesque Arabian Gulf, providing residents with stunning beachfront views and easy access to pristine beaches. This proximity to the coast allows for a serene and luxurious beach lifestyle.

- Strategic Growth Potential. The location holds immense growth potential. As a part of Dubai’s continuous expansion, it is poised to become a thriving hub for residential and commercial activities, making it an ideal place for long-term investments.

- Convenient Connectivity. The location provides easy access to major transportation routes, including highways, facilitating smooth commutes within the city and to other key areas of Dubai.

- Proximity to Key Neighborhoods. It’s conveniently close to some of Dubai’s most sought-after neighborhoods, including Dubai Marina and Jumeirah Beach Residence (JBR). These vibrant areas offer an array of entertainment, dining, and leisure options, enriching the resident experience.

- Accessibility to Airports. The development’s location ensures easy access to major airports. Al Maktoum International Airport, located within the nearby Dubai World Central (DWC), serves as a key transportation hub for both passengers and cargo.

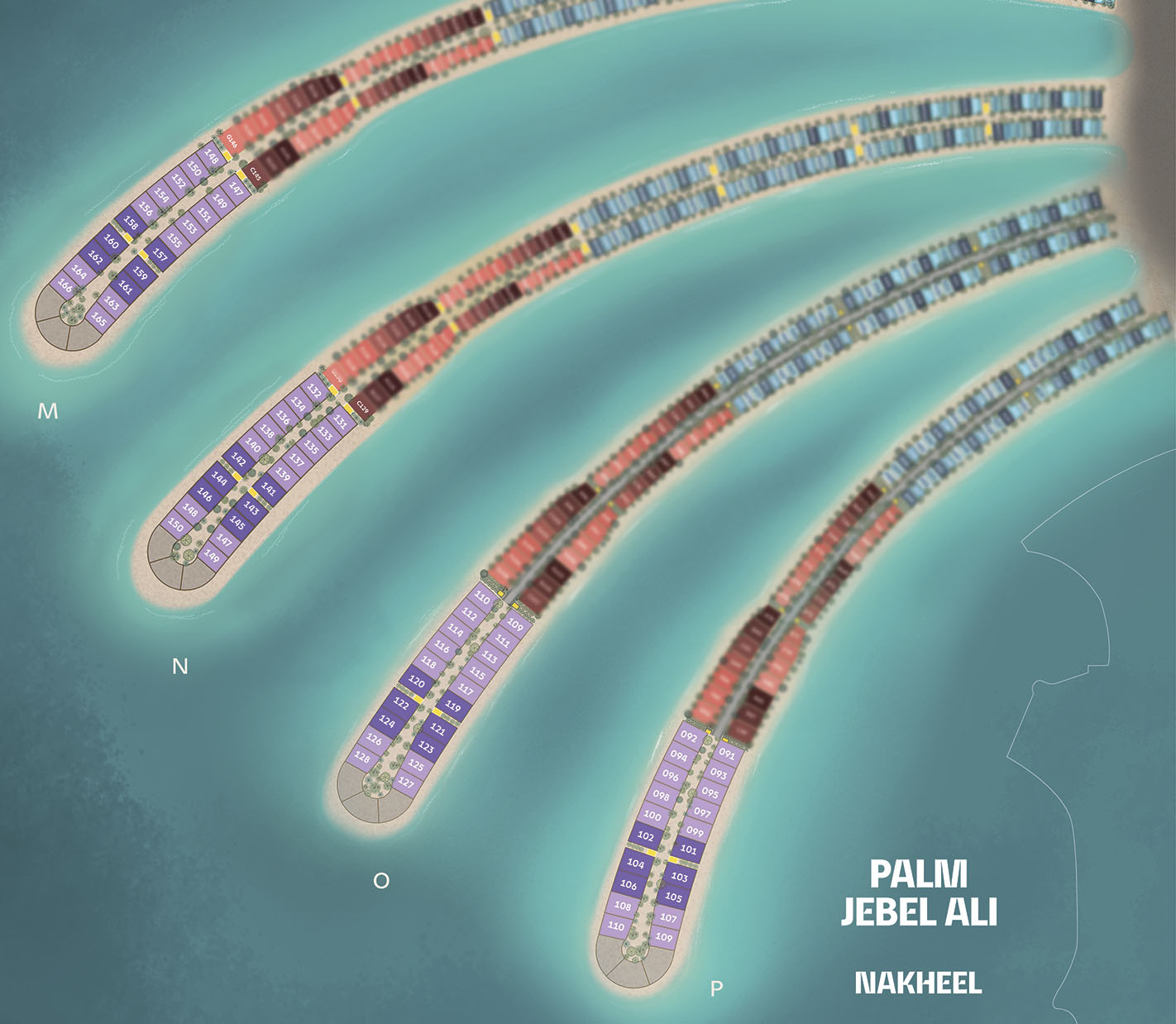

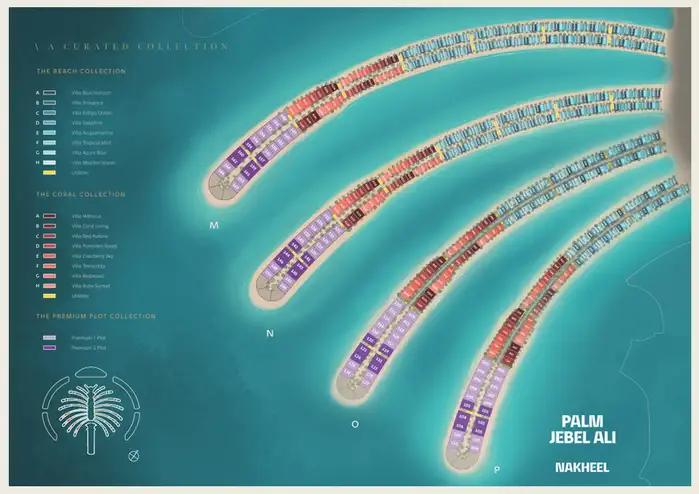

MASTER PLAN

The Master Plan envisions a spectacular development that redefines luxury living and entertainment in Dubai. According to the master plan, the island hosts a range of impressive features and attractions.

RESIDENTIAL COMMUNITIES

The island will be home to a diverse range of residential communities, including opulent villas, luxurious apartments, and waterfront properties. The emphasis on upscale living ensures a lavish lifestyle for residents.

HOTELS AND RESORTS

The island features a stunning array of over 80 hotels and resorts, promising world-class accommodations for tourists and visitors. These establishments offer unparalleled comfort and hospitality against the backdrop of the Arabian Gulf.

ENTERTAINMENT AND LEISURE

It boasts an extensive selection of entertainment and leisure options. Residents and guests can enjoy vibrant nightlife, fine dining, shopping districts, and cultural attractions, making it a self-contained entertainment hub.

GREEN SPACES

The master plan includes ample green spaces and parks, contributing to the island’s sustainability and offering residents areas for relaxation and recreation.

BEACHES AND WATERFRONT

With its strategic location along the Arabian Gulf, real estate in Palm Jebel Ali Dubai provides residents and visitors with direct access to pristine beaches and waterfront activities, enhancing the overall quality of life.

COMMERCIAL ZONES

The island’s master plan incorporates commercial zones, attracting businesses and investors looking to be part of this thriving community. It serves as a hub for commerce and innovation, contributing to Dubai’s economic growth.

TRANSPORTATION INFRASTRUCTURE

The development features modern transportation infrastructure, including road networks and access to the Dubai Metro, ensuring seamless connectivity within the city and beyond.

MASTER PLAN PDF

If you are interested in obtaining the master plan, please leave a request. Our licensed agent is ready to provide you with this document in PDF format for your review. The master plan is a key document that outlines the entire concept and strategy of this exciting development.

PROPERTIES FOR SALE in Palm Jebel Ali Dubai

Palm Jebel Ali is located in Dubai, offers a range of enticing properties for sale that cater to the diverse preferences of investors and homebuyers.

- Signature Villas. During the initial launches properties, buyers had the privilege of choosing from luxurious villas within the Beach and Coral collections. These collections represent the epitome of waterfront living, providing residents with not only opulent accommodations but also breathtaking views of the sea. The Beach collection, in particular, offers an exclusive beachfront lifestyle, allowing homeowners to relish the beauty of pristine beaches just steps from their homes.

- Premium Plots. In addition to these ready-to-move-in villas, premium plots of land are also available for sale. These plots provide buyers with the opportunity to build customized homes that perfectly match their preferences and requirements. Whether it’s designing a dream villa or crafting a unique residence, these premium plots offer the canvas for creating a personalized haven.

- Apartments. Excitingly, the developer has plans for new launches in the near future, featuring additional villas and apartment complexes. If you aspire to own a property in Palm Jebel Ali Dubai, this is the perfect time to express your interest and leave a request. Be prepared to seize the opportunity to acquire a piece of this exceptional waterfront community during these upcoming launches.

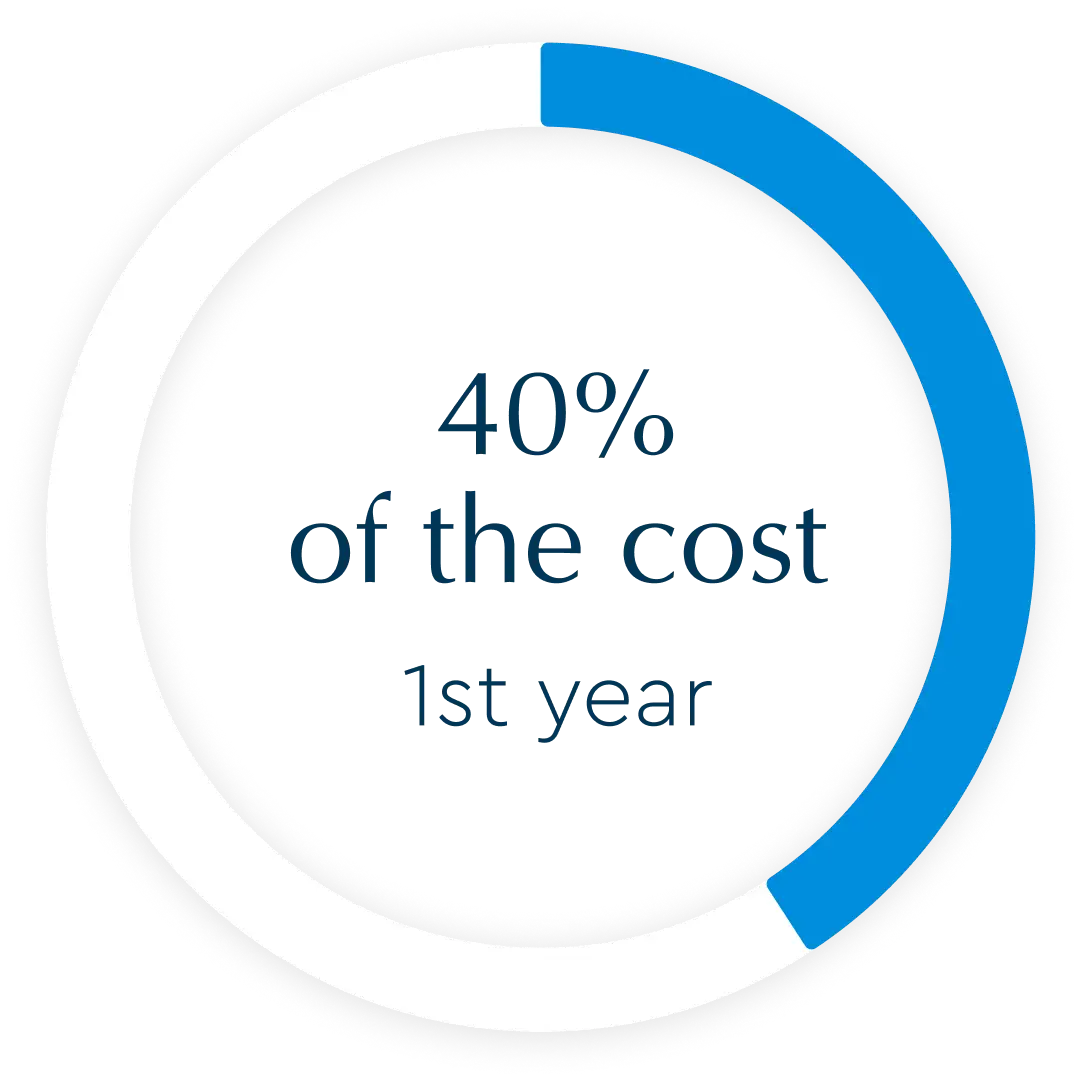

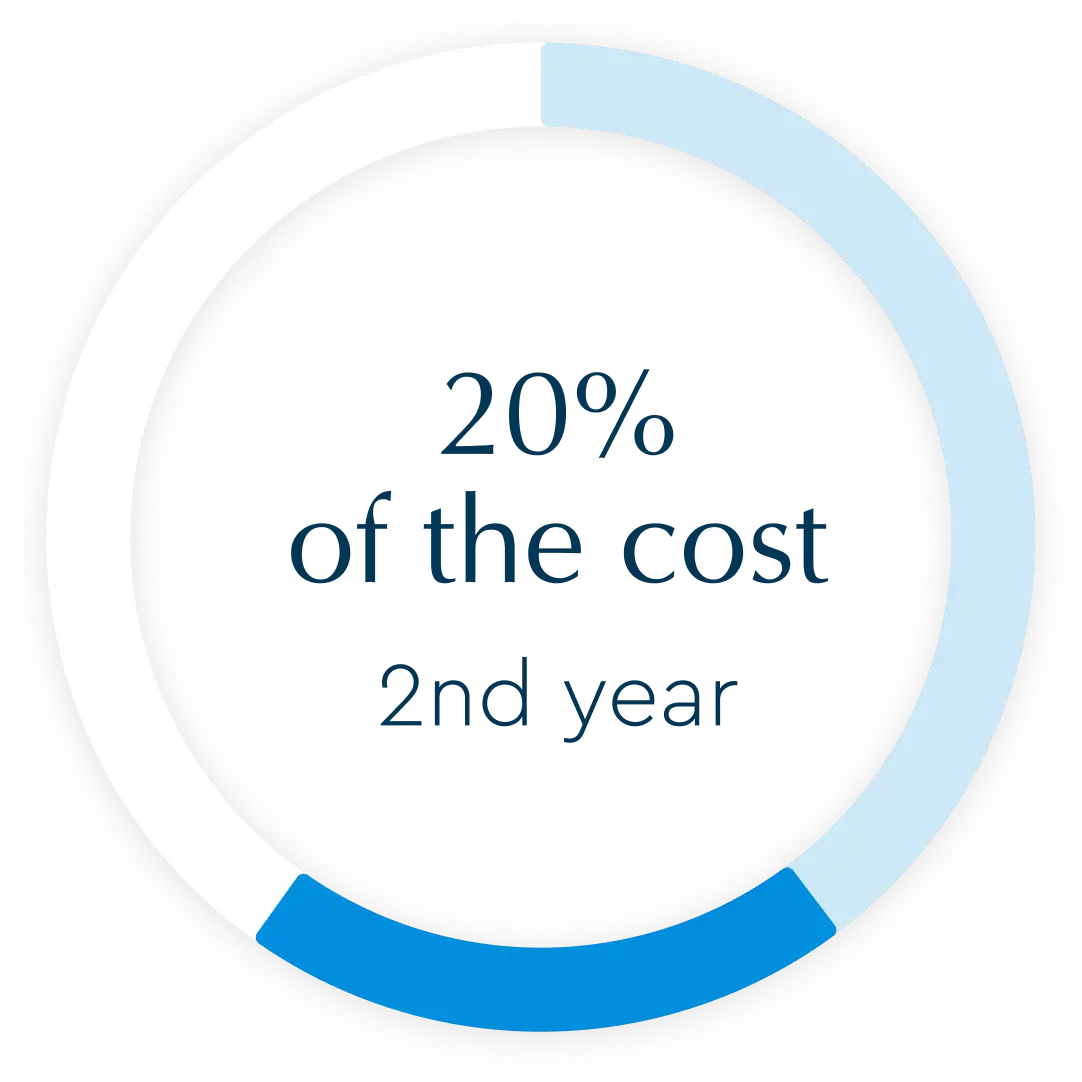

PAYMENT PLAN

The payment plan for property purchases is quite unique in the Dubai real estate market.

- High Down Payment. A down payment of 20% of the property’s value. This is significantly higher than the typical 5-10% down payment seen in Dubai’s property market. It sets a new standard for down payments, making it a requirement for serious buyers.

- Serious Buyers Only. The decision to demand such a high down payment is aimed at ensuring that only serious buyers commit to the property bookings. This approach reflects the developer’s confidence in the project’s success and its ability to attract high-end buyers.

- Full Payment at Handover. While many off-plan projects offer post-handover payment options, the property follows a different approach. Buyers are required to make a 20% down payment, followed by 60% payments during the construction phase, and the remaining 20% is due at the time of handover. This payment structure is designed to secure the project’s financial stability.

The payment plan is tailored to match the high-end nature of properties. The high down payment requirement has not deterred buyers but has contributed to the project’s success. It has generated substantial demand for exclusive homes.

Payment plan is characterized by a substantial 20% down payment, reflecting the developer’s confidence and attracting serious buyers for super-premium beachfront homes. This unique approach has set a new standard in Dubai’s real estate market.

WHEN WILL PALM JEBEL ALI BE FINISHED

The completion date a massive development project in Dubai, is expected to be in 2027. The completion date signifies when the entire project, including infrastructure, residential units, and amenities, is anticipated to be finished and ready for occupancy.

LUXURIOUS AMENITIES AND SERVICES

Palm Jebel Ali is set to redefine luxury living with a plethora of amenities and services.

- 80 Hotels and Resorts. The project boasts an impressive array of 80 hotels and resorts, offering visitors and residents a wide range of accommodation options.

- Leisure and Retail Amenities. The project features numerous leisure and retail options, creating a vibrant and aspirational environment for its residents.

- Waterfront Living. It aims to set a global benchmark in waterfront living, providing residents and families with luxurious lifestyle amenities and stunning views of the coastline.

- Beachfront Homes. The project aims to offer new beachfront homes for approximately 35,000 families.

- Luxurious Amenities. It features top-notch amenities such as spacious apartments, private parking spaces, CCTV camera security, and more, ensuring a comfortable and secure living environment for its residents.

In the coming years, it’s poised to become a symbol of opulence, offering a lifestyle like no other in one of the world’s most dynamic cities.

IS PALM JEBEL ALI A GOOD INVESTMENT?

Investing in villa is a promising opportunity with several key justifications and facts to support its potential as a good investment.

LOCATION AND GROWTH POTENTIAL

Property is strategically located in Palm Jebel Ali Dubai, a city known for its economic stability and growth. The project’s revival and the influx of buyers indicate renewed interest, suggesting the potential for property value appreciation.

MARKET DEMAND

Recent sales re-launch events have seen high demand, with properties selling out quickly. The interest from both local and international buyers indicates strong market demand.

PROPERTY PRICES

Property prices for villa in Palm Jebel Ali start at AED 18 million, reflecting the exclusivity and luxury of the development. While prices are high, they align with Dubai’s upscale real estate market.

PROJECTED PRICE GROWTH

Analysts anticipate significant price growth, with projected villa prices reaching AED 30 million per unit. This suggests the potential for substantial returns on investment.

PAYMENT STRUCTURE

The 20% upfront payment requirement demonstrates the seriousness of buyers. The phased payment approach (20% upfront, 60% during construction, and 20% on handover) allows for manageable financial planning.

DEVELOPMENT SCALE

Developer is set to villa for sale over 35,000 families upon completion, making it a massive project with significant potential for long-term growth.

DIVERSIFIED REAL ESTATE OPTIONS

Nakheel offers a range of real estate options, including luxurious villa for sale, apartments. Diversifying your investment portfolio within the project is possible.

LONG-TERM VISION

The revival of the Palm Jebel Ali project aligns with Dubai’s long-term vision, indicating a commitment to its success.

Palm Jebel Ali presents a promising investment opportunity, considering its location, market demand, payment structure, and the overall economic environment in Dubai.

NEW LAUNCH

The first launch of villa took place on September 20, 2023. This ambitious and highly anticipated project has garnered immense attention due to its grand relaunch.

What makes this launch particularly noteworthy is not only the scale of the project but also the demand it has generated. Villa has already started selling out rapidly, indicating strong interest and enthusiasm among investors and homebuyers.

Looking ahead, there are expectations of several more launches within the Palm Jebel Ali development. However, it’s important to note that the supply of real estate properties is limited, while the demand remains substantial. As a result, prospective buyers and investors are encouraged to register their interest in advance and submit applications to secure their place in this exciting and sought-after venture.

Palm Jebel Ali Photos

Palm Jebel Ali Video Tours

HOW TO BUY PROPERTY IN PALM JEBEL ALI

FAQ

What Happened with Palm Jebel Ali?

The man-made archipelago, Palm Jebel Ali, situated in Dubai, was initially designed to be the second of three Palm Islands, following the success of Palm Jumeirah. However, the project encountered substantial hurdles and was eventually suspended due to the global financial crisis in 2008. Fast forward to 2023, a megaproject in Dubai has been revived. His Highness Sheikh Mohammed bin Rashid Al Maktoum, the UAE Vice President, Prime Minister, and Ruler of Dubai, reintroduced the venture.

Is Palm Jebel Ali Sold Out?

The Palm Jebel Ali villas in Dubai are completely sold out, with an overwhelming rush and massive demand. The first phase sold out within hours of the launch, witnessing long queues and reports of extensive crowds at the Nakheel Sales Centre. This frenzy indicates a strong interest in luxury real estate on the Palm Jebel Ali. Stay tuned for upcoming launches of new villas, residential complexes, and apartments on our website.

Do People Live on Palm Jebel Ali?

At present, Palm Jebel Ali is not inhabited by residents. However, significant construction and development are ongoing on the island. There are extensive construction and infrastructure activities progressing, signaling the ongoing growth and evolution of the area. The construction efforts are indicative of the island's transformation into a future residential, commercial, and leisure destination.

Who is Building Palm Jebel Ali?

Palm Jebel Ali is being constructed by Nakheel Properties. The development is managed by Nakheel, a prominent real estate developer in the United Arab Emirates, known for ambitious projects. Palm Jebel Ali, the second Palm Island project, is planned to be larger than the Palm Jumeirah, promising an array of residential and commercial spaces.

What are the Plans for Palm Jebel Ali?

Palm Jebel Ali is planned to be double the size of Palm Jumeirah and will encompass seven interconnected islands featuring diverse, walkable neighborhoods and state-of-the-art infrastructure. The development integrates smart city technologies, sustainable practices, and a commitment to establishing a lively, flourishing community. Envisioned features comprise six marinas, over 80 residential complexes and hotels, a water theme park, and a 'Sea Village,' alongside multiple access points to the island.

Why to Invest in Palm Jebel Ali?

Investing in Palm Jebel Ali offers several advantages. Located in Dubai, this development provides a prestigious and highly desirable location in a vibrant city. Properties, particularly villas, show potential for promising returns and a high ROI due to the rising demand and scarcity of ultra-luxury real estate in Dubai. The area doesn't just offer luxurious residential estates but also commercial spaces, healthcare facilities, and various entertainment options.

Why is Palm Jebel Ali Still Empty?

Palm Jebel Ali is not currently an empty site. The project has seen delays and limited development due to declining demand in real estate following the global financial crisis of 2008. These challenges led to construction halts and slower progress. However, recent reports and initiatives indicate a renewed interest and plans to reinvigorate Palm Jebel Ali after 21 years, signaling a revitalization of the project.

What is the New project of Palm Jebel Ali?

The new project at Palm Jebel Ali, spearheaded by Nakheel, is a futuristic endeavor that encompasses various crucial components. Envisioned to be twice the size of the Palm Jumeirah, it will consist of seven linked islands covering an area of 13.4 square kilometers. Nakheel has initiated the initial phase of the project by introducing two villa types—Coral Villas and Beach Villas—positioned on four fronds of the island. Palm Jebel Ali aspires to become the world's largest man-made island, offering a blend of residential, commercial, and leisure amenities.

Is Palm Jebel Ali Built?

No, Palm Jebel Ali remains unfinished. Construction came to a halt in 2008 due to the global economic crisis and remained dormant for over 20 years. However, in 2023, the project developer, Nakheel Company, declared the restart of the project. His Highness Sheikh Mohammed bin Rashid Al Maktoum, officially launched Palm Jebel Ali, signifying an imminent intensification of work and the resumption of construction.

Why is Palm Jebel Ali on Hold?

Palm Jebel Ali was put on hold primarily due to the global financial crisis that hit in 2008, causing a significant slowdown in construction. However, it's important to note that as of the present day, the project is no longer on hold. Recent developments indicate a revival or restart of the project, with plans to intensify work and resume construction, particularly after the announcement made by Nakheel Company in September 2023, signifying a renewed focus on the project's progress.

How Many Villas Does Palm Jebel Ali Have?

Palm Jebel Ali comprises a total of 2002 villas. The luxury villas include two main types, Coral villas and Beach villas, with a total of eight styles available for each villa type. The Coral villas feature seven bedrooms, while the Beach villas offer five to six bedrooms, contributing to a futuristic waterfront living experience.

What is the Difference Between Palm Jumeirah and Palm Jebel Ali?

Palm Jumeirah, the first completed project, features a range of residential, leisure, and hospitality options. In contrast, Palm Jebel Ali, while designed similarly, is at an earlier stage of development. Palm Jebel Ali is larger than Palm Jumeirah. It was designed to be about twice the size of Palm Jumeirah. Also Palm Jumeirah is situated closer to the heart of Dubai, while Palm Jebel Ali is located further out, closer to the Jebel Ali port area.

Is Jebel Ali a Good Place to Live?

Palm Jebel Ali will be a good place to live. It features modern infrastructure, amenities, and well-planned residential communities. It provides convenient access to popular Dubai areas. Also it offers a range of lifestyle amenities, including shopping malls, leisure facilities, schools, and healthcare services, and there are various housing options available, from apartments to villas.

Why was Palm Jebel Ali Built?

Palm Jebel Ali was part of an ambitious initiative by the government of Dubai to expand and transform the city. The project was envisioned as a means to boost Dubai's profile as a global tourist and residential destination. It aimed to create iconic, luxury living spaces, leisure destinations, and commercial hubs, fostering economic growth and bolstering the city's reputation as an innovative and modern metropolis.

How Big is Palm Jebel Ali Compared to Palm Jumeirah?

Palm Jebel Ali is planned to be larger than Palm Jumeirah. It was designed to be approximately twice the size of Palm Jumeirah, making it a significantly larger development in the series of Palm Islands in Dubai.

When Was Palm Jebel Ali Made?

The construction of Palm Jebel Ali, one of Dubai's man-made islands, commenced in the early 2000s. The initial planning and construction stages began during this period as part of the Palm Islands development project. However, the project faced significant challenges and delays, particularly after the global financial crisis in 2008, which led to construction halts and subsequent stagnation.

How Big is Palm Jebel Ali?

Palm Jebel Ali spans across an area of 13.4 square kilometers of land, making it a substantial development in Dubai. It boasts the longest coastline of any destination in Dubai and is designed to encompass seven islands and 16 fronds, contributing to a total of 91 kilometers of beachfront. This development is set to feature three access points to the island, emphasizing its extensive size and connectivity.